PERFORMANCE

Warren Buffet was once asked if he had to make one investment decision for the rest of his life, what would it be? His answer was no surprise to those who followed his thinking. He would invest 80% of his funds in the S&P 500 Index and the balance in high-quality short-term bonds.

In practice, however, very few investors appear to follow this advice, and instead, they give control of their portfolios to investment advisors, the majority of which charge a fee only to underperform the S&P Index. It is said that over almost every investment cycle, the S&P 500 Index outperforms investment advisors 80% of the time. Over several investment cycles the percentage is even higher.

I started my investment advisory career in the mid-1970’s. Up until my retirement several years ago, I retained very few of the clients from that period. Normal attrition and the sweet talk of the competition assured that I wasn’t going to get wealthy from the fees I personally charged. While no two client track records are exactly the same, one stands out as fairly typical of an all equity portfolio. This individual insisted on all equities without regard to market timing.

In 1976, this client handed me a check for $100,000 which he received as a distribution from a partnership which was in the process of dissolving. Along with this deposit came approximately $20,000 of common stock he had purchased in preceding years. Over the years he never deposited any additional funds, and to my recollection, only withdrew some tiny amounts to cover taxes. Forty-two (42) years later both he and his wife passed away within a short time of each other, and in 2019, I handed their only daughter an account valued at $21,500,000.

Lest you think I’m making this up, consider that a $120,000 investment compounded at 13% annually will reach $21.5 million in 42 years. The point every investor should realize – making money takes time – making lots of money requires lots of time.

In 2009, according to performance statistics published by Morningstar at that time, the Equity Mutual Fund I managed was the second best performing diversified, unleveraged mutual fund in the country, out of over 6000 equity funds they covered. It was up over 83%. Starting the following year, in 2010, and over the next ten years, Morningstar gave a 5 Star rating to both of the Funds I managed (Income and Equity). Additionally, at my request, Morningstar searched their database and found that I was the only individual Fund Manager ever to achieve two simultaneous five-star ratings over 10 years.

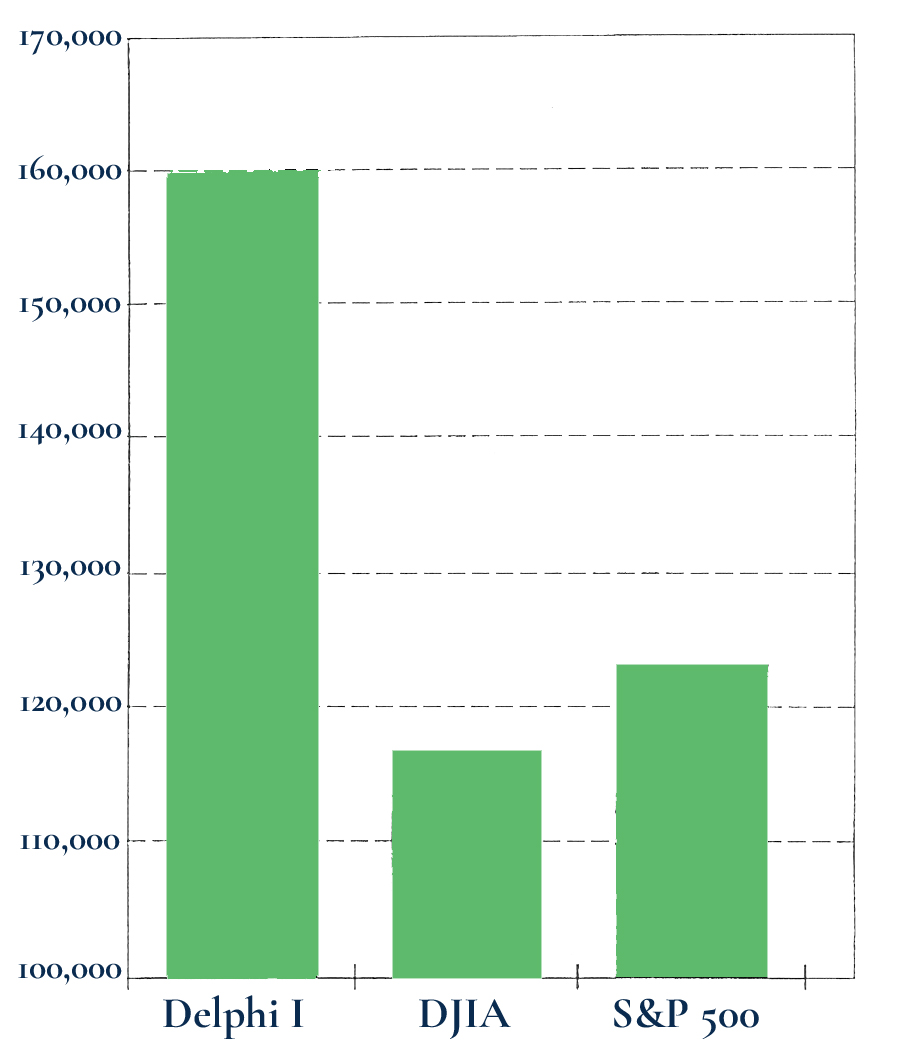

As a proxy for my performance, I’ve provided two charts, each representing a significant portion of the securities I used in achieving these returns. The Delphi I Partners performance chart shows the performance of a partnership I managed over several years. It is also the subject of a White Paper I presented to the Investment Company Institute in early 1991 (see White Papers). In achieving superior performance numbers for individual clients, I also used this proprietary model outside of Delphi for individual client transactions.

The second chart points to the two mutual funds I managed for Ancora clients beginning in 2010 and ending near 2020 (see above). The securities I invested in for each Fund were also the securities I used for individual client accounts.

Delphi I Partners

vs.

Dow Jones Industrial and S&P 500

From October 1, 1987 to May 31, 1991